ITR deadline:

People with annual salaries under ₹5 lakh would be assessed a late fee of ₹1,000, while those with annual salaries over ₹5 lakh will be assessed a late fee of ₹5,000. However, beyond the July 31 deadline, some taxpayers are permitted to file their taxes.

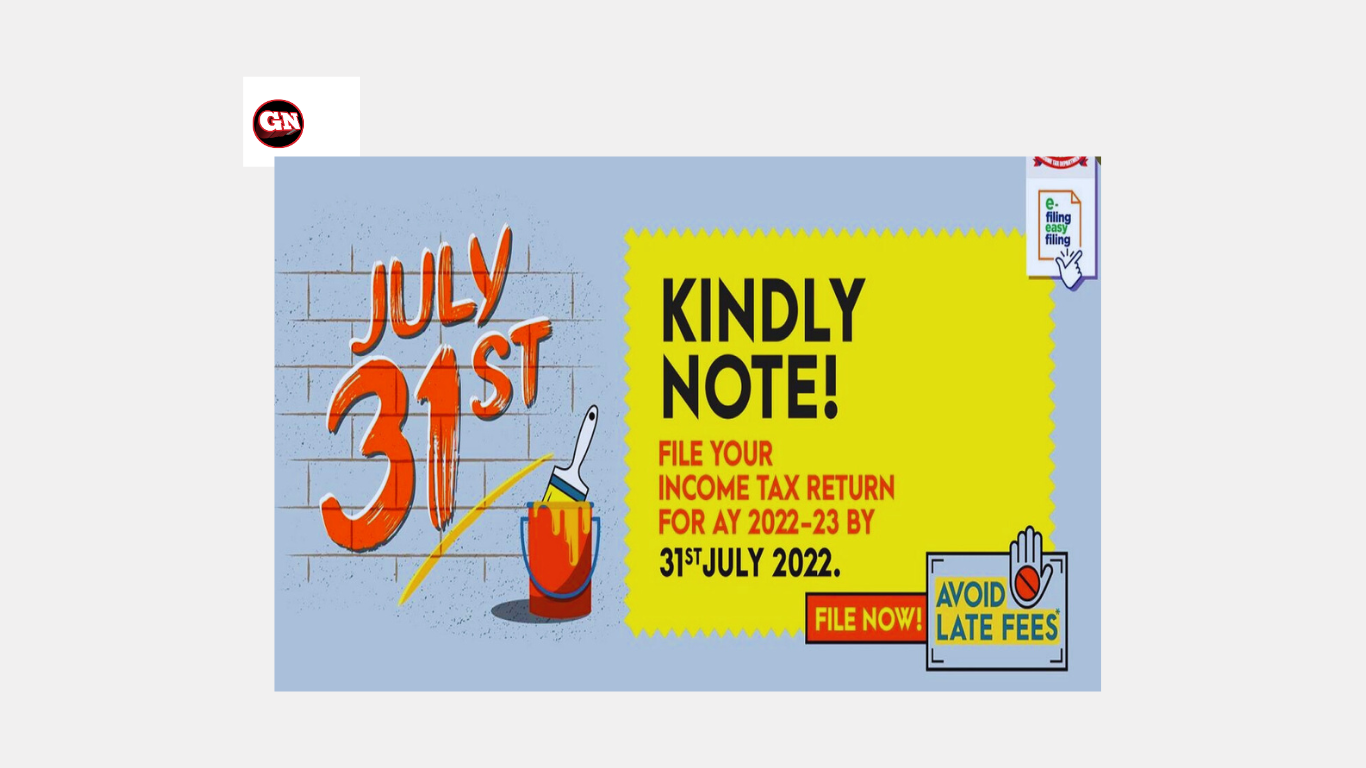

Your income tax return (ITR) must be filed by July 31, 2024, for the 2023–2024 fiscal year. There is a penalty, which varies depending on your income level, for filing your ITR after this deadline. Regarding who can file their ITRs even after the deadline, a lot of people have questions.

If an individual or organization needs their finances audited, the deadline for reporting ITRs has been extended to October 31, 2024. To allow you ample time to complete the audit and submit your ITR, an extension is being provided. Before submitting their ITR, the Income Tax Department gives these people an additional three months to finish their audit with a reputable chartered accountant.

Extra time to file for some taxpayers

There are some taxpayer categories that are given more time to file their ITRs. Among these are:

1> Companies that transact internationally usually require a great deal of documentation and analysis for transfer pricing. They have been given an extended deadline of November 30 to file their ITRs in order to meet this.

2> Detailed reporting and compliance procedures might be necessary for businesses involved in certain domestic activities. As a result, an extension of the filing date may be available to some taxpayers.

Eligibility for these extensions may include complicated conditions that depend on specific provisions of the Income Tax Act. Extended deadlines may not always eliminate the possibility of late filing costs.

Penalties for filing your ITR after the deadline.

For an ITR filed after the deadline, the penalty is based on your taxable income:

1> A penalty of up to Rs. 1,000 is levied on taxable income up to Rs. 5,00,000.

2> Taxable income above Rs. 5,00,000 is subject to a maximum penalty of Rs. 5,000.

ITR deadline: There is this penalty on top of any interest that may be due on the amount of delinquent taxes. For companies subject to certain restrictions, such audit requirements or participation in foreign transactions, extended filing dates are allowed. It is still possible, nevertheless, under some circumstances, to incur late filing penalties.

The numerous tax deadlines and regulations might be bewildering to many individuals. The Income Tax Department has made significant strides toward improving services for taxpayers, including offering round-the-clock support via several channels to guarantee increased convenience.

By enabling taxpayers or ITR deadline to seek assistance whenever they need it, regardless of their location or time zone, this enhances accessibility. Taxpayers can select the communication channel that best fits their needs, and prompt problem solutions lowers tension and irritation.

A social media user posing as a chartered accountant claimed that even though you correctly filed your income tax returns or ITR for current assessment year, your tax refund would be delayed.

CA Income tax refunds “will take time this year,” according to a post on X (previously known as Twitter) by Anand Luhar, who purports to be affiliated with the Institute of Cost & Works Accountants of India (ICWAI). He asserted that this was because the I-T Department intended to examine ITR submissions using specialized artificial intelligence tools.

Automated ITR Process for CA Claims.

ITR deadline:

“This year’s IT refund will take some time. The returns will be closely examined by them. To do this, they are modifying and customizing an artificial intelligence software program (AI) that was created specifically to examine the ITR deadline ITR field. According to Luhar, this program will automatically gather data associated with your PAN card first, and then it will do the same with your Aadhar card.