Hindenburg vs. Adani

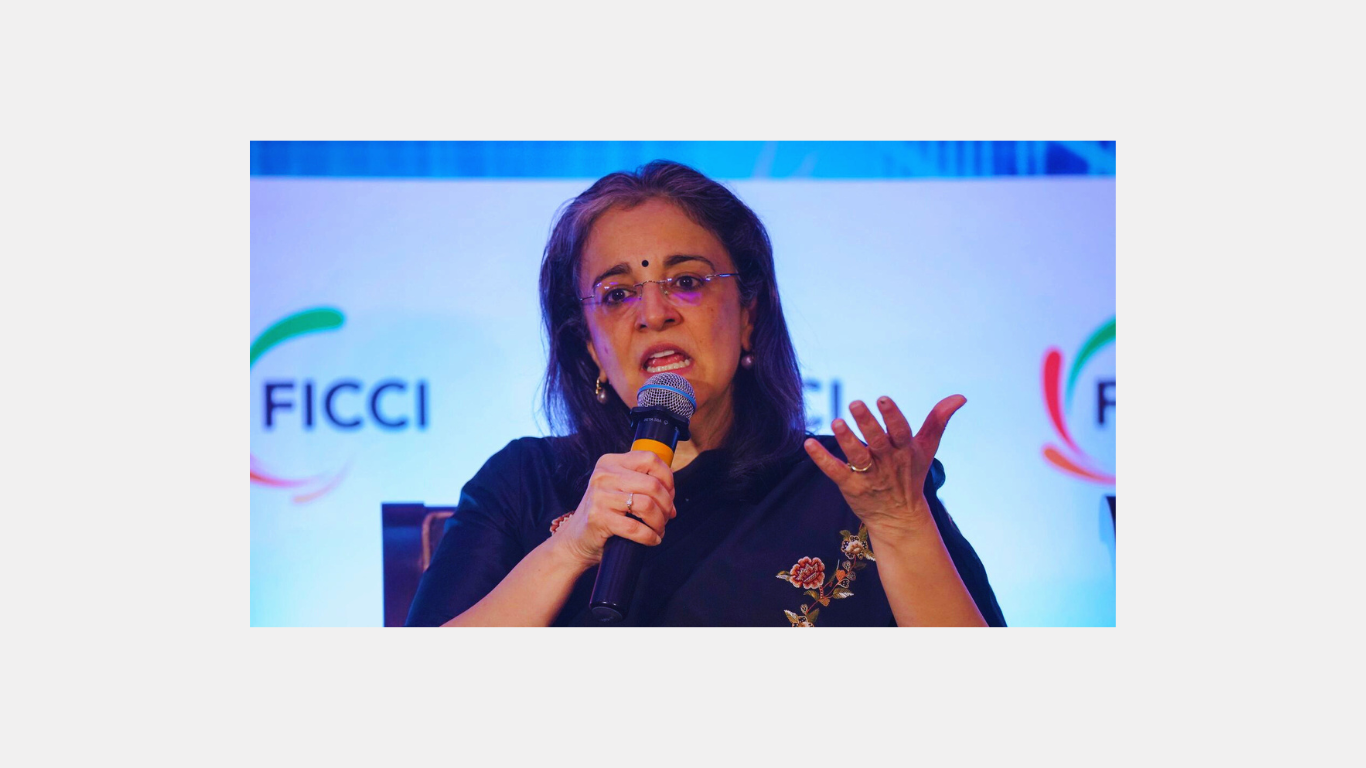

MUMBAI: On Saturday, US-based short seller Hindenburg Research claimed that in what is being called the “siphoning scandal,” Vinod Adani, the brother of billionaire Gautam Adani, used “obscure” offshore funds in Bermuda and Mauritius, and that SEBI Chairperson Madhabi Buch and her husband, Dhaval Buch, held hidden stakes in.

According to Hindenburg, this explains why the regulator of India’s capital markets was reluctant to look into the Adani Group in detail.

The price of the Adani Group’s stock fell sharply after Hindenburg released a damning report in January 2023 charging the business with accounting fraud and stock manipulation.

The Supreme Court has backed the Adani Group’s position, which has been to continually refute these accusations.

In its 2017 ruling, the Supreme Court pointed out that SEBI’s probe into the Adani case had not yielded meaningful findings.

In a second report published late on Saturday, the short seller said, “We suspect Chairperson Madhabi Buch’s involvement with the same funds used by Vinod Adani may be the reason SEBI’s reluctance to take meaningful action against suspected offshore shareholders in the Adani Group.”

Hindenburg vs. Adani

Hindenburg claims that papers leaked by whistleblowers show that Buch and her spouse first opened an account in Singapore on June 5, 2015, with IPE Plus Fund 1.

Through India Infoline (IIFL), a listed asset management company connected to the German Wirecard scam, a director of Adani established the small offshore Mauritius fund known as “IPE Plus Fund.” According to reports, Vinod Adani diverted money from the Adani Group’s overbilling of electrical equipment by using this framework to invest in Indian markets, according to Hindenburg.

As to the report, the SEBI Chairperson could have begun by examining herself in the mirror if she was truly determined to identify the holders of offshore funds. The reluctance of SEBI to pursue a path that could have resulted in the appointment of its own chairman is not surprising.

Remarkably, in April 2017, Buch was designated by SEBI as a “whole-time member”.

Hindenburg vs. Adani

According to the study, a firm under the management of Vinod Adani made an investment in the “Global Dynamic Opportunities Fund” (GDOF) in Bermuda, a tax haven which is a British overseas territory. The fund subsequently made an investment in IPE Plus Fund 1, which is registered in Mauritius, another tax haven. This complicated structure was described.

A different inquiry by a financial daily disclosed that two Adani associates utilized the Global Opportunities Fund (GOF), a fund domiciled in Bermuda, which is the parent of GDOF, “to amass and trade large positions in shares of the Adani Group.”

IIFL is in charge of overseeing these nestled funds.

“In brief, despite the existence of thousands of mainstream, reputable onshore Indian mutual fund products, an industry she now regulates, documents show SEBI Chairperson Madhabi Buch and her husband had stakes in a multi-layered offshore fund structure with minuscule assets, traversing known high-risk jurisdictions, overseen by a company with reported ties to the Wirecard scandal, in the same entity run by an Adani director and significantly used by Vinod Adani in the alleged Adani cash siphoning scandal,” stated Hindenburg.

Here are Some points on the Hindenburg-Adani saga 2.0.

Hindenburg vs. Adani

- The American short-seller made a statement on her blog that is certain to cause a stir in the Indian political scene. “Madhabi Buch, the current chairperson of SEBI, and her husband had stakes in both obscure offshore funds used in the Adani money siphoning scandal.”

- The stock prices of the Adani Group companies were inflated, according to Hindenburg’s 2023 charges, by mysterious offshore monies located in Mauritius and Bermuda that were purportedly managed by Gautam Adani’s elder brother Vinod Adani.

- The corporation stated that the source of the covert investment was pay and that the couple’s estimated net worth was $10 million, citing an IIFL document.

- It asserted that Sebi had “drawn a blank” in its inquiries into the sources of funding for Adani’s offshore shareholders, as stated in the Supreme Court’s ruling. Hindenburg said the market watchdog was unwilling to look into a possible financial trail that its chairperson may have taken. The chairman of SEBI might have began by examining himself in the mirror if the agency’s goal was to identify the owners of offshore funds. The reluctance of SEBI to pursue a path that could have led to its chairperson is not surprising, the statement continued.

- In the meantime, Dhaval Buch and Madhabi Puri Buch refuted the accusations. “We would want to clarify that we vehemently reject the unfounded accusations and insinuations stated in the Hindenburg Report of August 10, 2024, about the claims made against us. The same has no truth to it. Our finances and personal lives are transparent. They maintained that over the years, SEBI has previously received the necessary disclosures.

- Hindenburg Research charged Adani Group in January of last year of committing “the largest con in corporate history” by manipulating stock prices and inflating revenue through a network of firms located in tax havens while accruing mounting debt. Every accusation was refuted by the conglomerate. Still, as the group’s share values crashed, the corporation saw a tremendous erosion of its wealth. The company’s market worth nearly dropped by $150 billion. They have now recouped a large portion of the money they lost throughout the previous few moonth.

- Hindenburg vs. Adani: Congress, alarmed by the explosive accusations, urged that the Center take prompt action to remove any conflict of interest from the regulator’s inquiry of the Adani Group. “This had tied its hands to the extent that ‘the securities market regulator suspects wrongdoing, but also finds compliance with various stipulations in attendant regulations… It is this dichotomy that has led to SEBI drawing a blank worldwide’,” Jairam Ramesh stated in reference to the Expert Committee.

- Hindenburg vs. Adani: In the meantime, Dhaval Buch and Madhabi Puri Buch refuted the accusations. “We would want to clarify that we vehemently reject the unfounded accusations and insinuations stated in the Hindenburg Report of August 10, 2024, about the claims made against us. The same has no truth to it. Our finances and personal lives are transparent. They maintained that over the years, SEBI has previously received the necessary disclosures.